Q&A: How to Tackle Credit Card Debt This Holiday Season

Everything you need to know with DU professor Ali Besharat

As shoppers enter the home stretch for holiday purchasing, a peek at their credit card debt can be very intimidating. Ali Besharat, an associate professor at the Daniels College of Business, shares his expertise with the DU Newsroom. He is co-director of DU’s Consumer Insights and Business Innovation Center.

How do some consumers find themselves deep in credit card debt in the first place?

Credit card issuers divide borrowers into two groups: “convenience users” who pay the full balance each month and “revolvers” who allow their balance to roll over from one billing cycle to the next, paying interest charges month to month. Many consumers who carry a credit card balance may find it impossible to get out of debt, because they are paying primarily for accumulated interest charges rather than the cost of their purchases.

Debt revolvers accumulate debt because they borrow money to buy things they cannot pay back. They tend to use their emotional side of their brain, leading them to excessive credit card bills. Emotional decisions are not meant to take into account interest rates and debt payment plans. The immediate gratification from impulsive decisions inhibits their ability to think rationally, and they convince themselves to purchase the merchandise now and deal with the payment later.

How should consumers decide what credit card debt to pay off first?

If you have a balance on more than one credit card, always pay back the credit card with the highest interest rate first, irrespective of the size of the balance. Also, all expenses on your credit card must be viewed the same. Avoid emotional attachment to certain expenses, and do not postpone their payment until they are experienced, like an expense for a vacation package which has yet to occur. While it is tempting to pay for past expenses first and delay the payment of future expenses, try to avoid it. Finally, all sources of your income, regardless of their origins (salary, bonus, tax return, etc.) should equally assist you in attaining your debt-reduction goals. For instance, never allow your mind to trick you that windfall money, like a reward check, is only meant for fun-oriented activities and could not be used toward your debt payment.

Is any amount of credit card debt harmful?

A debt is considered healthy when it is leveraged to purchase appreciating assets. However, a credit card debt isn’t a healthy one for the following reasons:

● Interest rates on credit card balances are usually very high (14–26%). Credit card companies may provide the option of making partial or minimum payments toward the full balance, but the failure to pay the full balance will result in accruing interest in a compounding rate. Many debtors who roll over their balance from one billing cycle to the next may find it impossible to climb their way out of debt.

● The debt is primarily used for depreciating purchases (e.g., household items, home furnishings, fashion, etc.)

● Research shows that people spend more when paying with a credit card compared to other forms of payment like cash, check or debit cards because the pain of payment (the negative feeling of parting with money) is less obvious.

Does “snowballing” help consumers become debt free faster?

Some financial advisors, including [TV personality] Dave Ramsey, advocate “debt snowball,” which is paying off small balances ahead of larger balances. Recent research demonstrates that people are more successful when they follow easy-to-difficult sequence when completing sub-goals. In related research using secondary data from a consumer debt settlement firm, researchers illustrate that closing individual debt accounts is a significant predictor of overall debt elimination after controlling the dollar balance of the closed accounts. This finding provides evidence that the illusion of goal progress motivates debtors to persist in pursuit of the higher level and long-term goal of being debt free.

However, the debt snowball method should be employed with caution. This approach is only fruitful in certain scenarios of debt reduction in which interest rates among debt accounts do not vary greatly. When large differences exist among interest rates of debt accounts, the financial benefits of paying off debts from highest to lowest interest rates outweighs the motivational benefits obtained from debt snowballing.

What’s the best way to repair my credit score after taking on too much credit card debt?

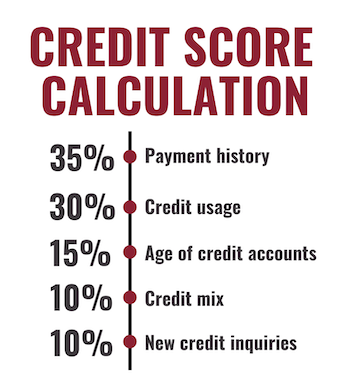

Before we discuss the best strategies to improve your credit score, let’s briefly overview how the credit score is calculated. Your score is composed of five distinct factors:

As you can see above, payment history has the most impact on your credit score. If you paid your debts responsibly and on time, it works in your favor. If not, the quickest way to fix your score in a significant way is to pay (even the minimum payment) scheduled balances on time going forward and avoid late payments at all costs.. That is also why it is highly recommended to have paid-off debts, such as your old car loans, remain on your record.

The second effective method to boost your credit score is to keep your credit utilization below 30%. This index signals creditors that you can manage your available credit responsibly without maxing out your credit limits. Third, your score is determined by looking at the age of your oldest account and the average age of all your accounts. Therefore, avoid closing your oldest accounts because it can affect your credit utilization ratio and make it harder to build a solid credit history. Forth, there are two type of accounts when it comes to lending: installment accounts (e.g., mortgages, car loans, and student loans) and revolving accounts (e.g., credit cards and lines of credit). Your healthy mix of accounts indicates to the creditors that you’re able to handle different types of credit. If you’ve only had credit card loans in the past, a car loan or a mortgage can elevate your credit score, as long as you could afford it. Finally, the history of applying for credit is crucial. Avoid applying for several credit accounts in a short period of time as it can hurt your credit.